michigan property tax rates by county

For more details about the property tax. Ad Compare Your 2022 Tax Bracket vs.

States With The Highest And Lowest Property Taxes Property Tax Tax States

County Treasurer adds a 235 fee.

. An appraiser from the countys office establishes your propertys market value. Multiply the taxable value by the millage rate and divide by 1000. Kent County collects on average 156 of a propertys assessed fair.

Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 205369 385369 145369. 84 rows When comparing Michigan real property tax rates its helpful to review effective tax.

For example if a property is a principal residence with a taxable value of 50000 and is located in Humboldt Township in the. Get In-Depth Property Tax Data In Minutes. Discover Helpful Information and Resources on Taxes From AARP.

Simply enter the SEV for future owners or the Taxable Value. The median property tax in Michigan is 214500 per year based on a median home value of 13220000 and a median effective property tax rate of 162. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313.

2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. The average effective property tax rate in Macomb County is 168. The Millage Rate database and.

When property taxes are not paid to the city or township treasurer by February 28 the delinquent taxes are. Start Your Homeowner Search Today. Alger Au Train Twp 021010 AUTRAIN-ONOTA PUBLIC 245800 425800 185800.

Wayne County collects on average 207 of a propertys assessed. That updated value is then multiplied times a combined levy from all taxing entities together to set tax due. Oakland County collects on average 175 of a propertys.

The median property tax in Macomb County Michigan is 2739 per year for a home worth the median value of 157000. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. 2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY.

The median property tax in Kent County Michigan is 2296 per year for a home worth the median value of 147600. 84 rows To find detailed property tax statistics for any county in Michigan click the countys. Macomb County collects on average 174 of a propertys.

Interest increases from 1 per month to 15 per month back to 1st prior year. See Property Records Tax Titles Owner Info More. Find County Online Property Taxes Info From 2022.

2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. Alger Au Train Twp 021010 AUTRAIN-ONOTA PUBLIC 267621 447621 207621. The median property tax in Wayne County Michigan is 2506 per year for a home worth the median value of 121100.

Ad Searching Up-To-Date Property Records By County Just Got Easier. The median property tax in Oakland County Michigan is 3573 per year for a home worth the median value of 204300. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

Current local tax information is available by contacting your local treasurers office. Property is forfeited to county treasurer. Search Any Address 2.

Your 2021 Tax Bracket to See Whats Been Adjusted. You can look up your recent appraisal by filling out the form below.

Maureen Francis On Twitter Property Tax Financial Information Public School

Pin By Raf On Adam Reality Property Tax Government Constitution

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Why Should I Own If I Can Rent Lovelansing Lansing Puremichigan Igersmichigan Michigan Dewittmichigan Dewittmi Ok Sell My House Lansing Michigan Lansing

Taxes By State A Map Of The U S Best Places To Retire Retirement Locations Map

Senior Outreach And Assistance Provides Information Referrals And Follow Up To Link Seniors With Specific Needs To Available Resources Kent County County Kent

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Michigan Property Tax H R Block

State Tax Maps How Does Your State Rank Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Property Taxes By State Report Propertyshark

North Central Illinois Economic Development Corporation Property Taxes

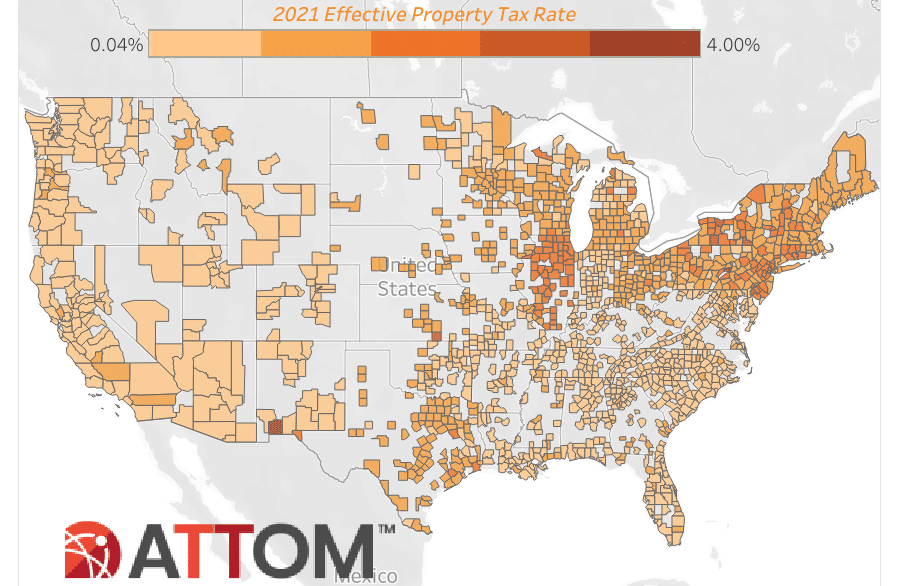

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Michigan Property Taxes By County 2015 Property Tax House Outline Home Icon

State Corporate Income Tax Rates And Brackets Tax Foundation

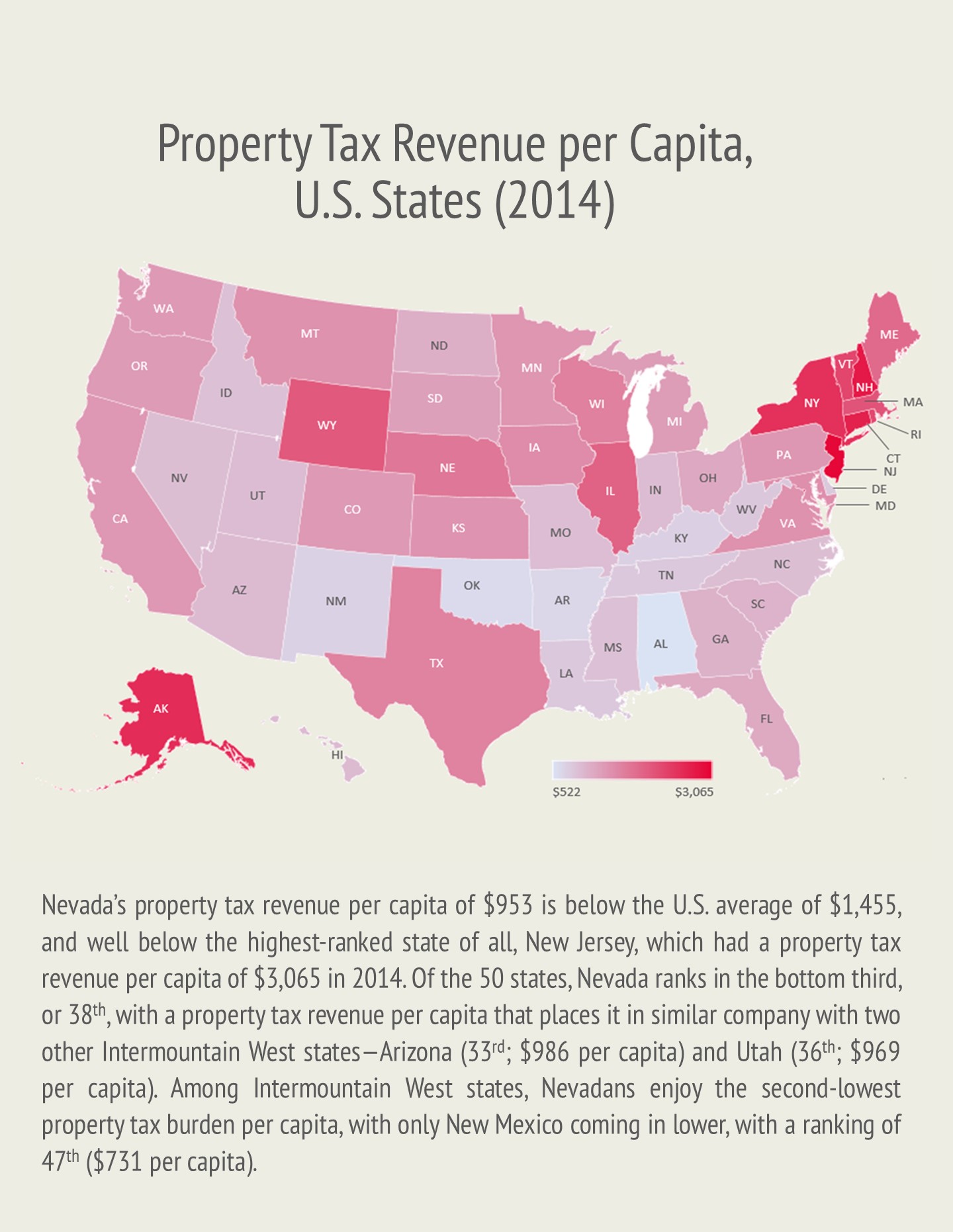

Property Taxes In Nevada Guinn Center For Policy Priorities

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

Unfair And Unpaid A Property Tax Money Machine Crushes Families Property Tax Tax Money Money Machine